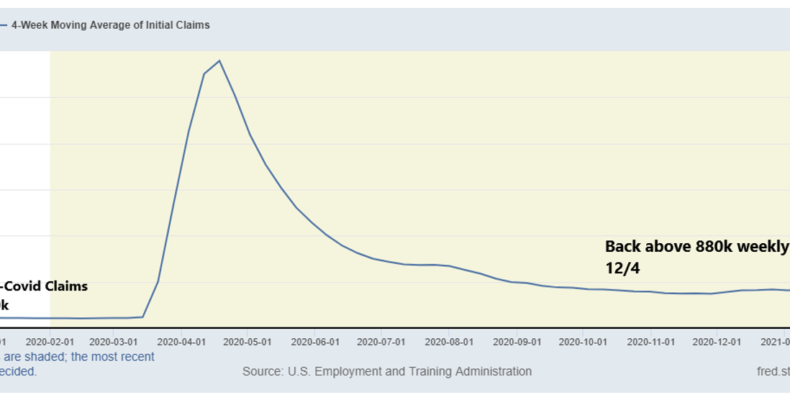

February 19th marked one year since the pre-pandemic highs on the S&P500. We closed this week at 3906, or 15% higher for the one-year period. Small-Caps and Growth leading since last year’s highs. Weekly unemployment claims continue to be stubbornly high, coming in again above 850k and the four-week moving average…

Week 7 Talking Points

Recent Comments