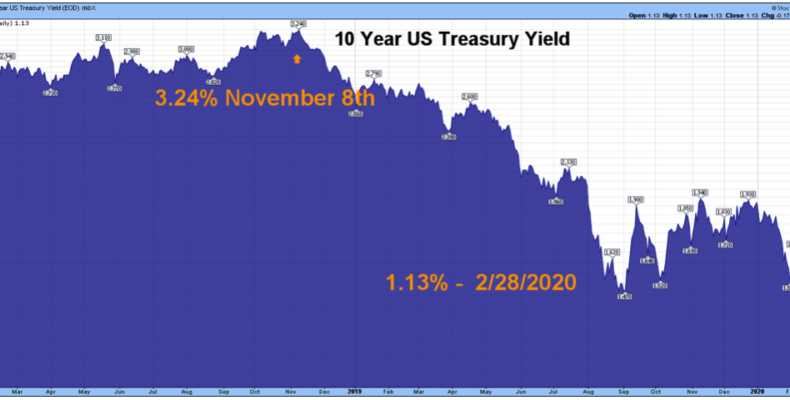

This week’s slaughter occurred more than a month after the virus really gained attention. Initially, the market traded like the virus would be contained to China but that is not the case anymore. In eight trading days, the S&P has fallen 12.76% from all-time highs. Markets have been rattled by…

Week 9 Talking Points

Recent Comments