For financial advisors, achieving sustained growth is essential for advisors committed to thriving in the industry. For growth-oriented financial advisors, including both independent practitioners and those affiliated with wirehouses, effectively monetizing your practice is a critical endeavor. As markets shift and client needs change, financial advisors must embrace innovative growth strategies for financial advisors that will expand their business and bolster profitability.

This article outlines actionable growth strategies tailored to the unique challenges and opportunities faced by financial advisors, providing insights that empower you to successfully monetize your practice.

How to Analyze Your Financial Advisor Practice’s Value

To effectively monetize your financial advisory practice, a comprehensive analysis of its value is indispensable. Begin by evaluating your current client base and assets under management (AUM). Understand the demographics, preferences, and financial needs of your clients.

Assess the distribution of AUM across different client segments to identify potential growth areas. Simultaneously, scrutinize your operational efficiency and scalability. Streamlining processes, embracing technology, and optimizing resource allocation can enhance overall efficiency, allowing for scalability as your practice expands.

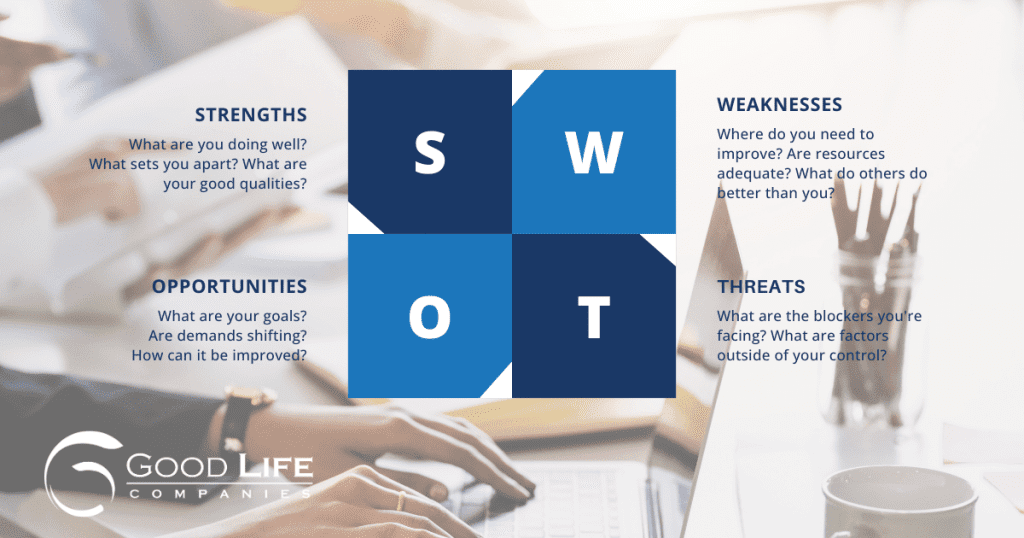

Conducting a SWOT analysis is pivotal in uncovering crucial insights. Identify the strengths that set your practice apart, such as specialized expertise or outstanding client service. Acknowledge weaknesses, such as operational bottlenecks or potential skill gaps within your team. Explore opportunities for growth, whether through niche markets or expanded service offerings.

By methodically examining these elements, financial advisors can gain a holistic understanding of the value of their practice. This foundational analysis not only facilitates strategic decision-making but also lays the groundwork for implementing growth strategies that capitalize on strengths, address weaknesses, seize opportunities, and mitigate

Monetization Strategies for Growth-Minded Financial Advisors

In the pursuit of sustained growth, financial advisors must proactively explore diverse avenues for monetizing their practices. This involves not only optimizing existing revenue streams but also strategically diversifying to capture new opportunities.

Here are three pivotal strategies that growth-minded financial advisors can adopt to enhance their practice’s monetization:

Exploring New Service Offerings

Diversification begins with expanding the scope of services offered. Consider aligning additional offerings with evolving client needs. This could involve providing comprehensive financial planning, estate planning, or specialized services for specific industries. By staying attuned to market demands and tailoring services accordingly, you can attract new clients and deepen relationships with existing ones.

Leveraging Technology for Efficiency Gains

Embracing technological advancements is crucial for operational efficiency and scalability. Implementing cutting-edge tools for client management, portfolio analysis, and communication not only enhances the client experience but also frees up time for advisors to focus on strategic growth initiatives. Automation of routine tasks and the integration of digital platforms can lead to significant efficiency gains, allowing financial advisors to manage a larger client base without proportionally increasing overhead costs.

Introducing Fee-Based Models

Transitioning towards fee-based models, such as fee-only or fee-based advisory services, provides a more predictable revenue stream. This approach aligns the advisor’s success with that of their clients, fostering a transparent and mutually beneficial relationship. Fee-based models can enhance client trust and loyalty while offering financial advisors a stable income base, reducing reliance on market-driven fluctuations.

By combining these strategies, financial advisors can fortify their practices against uncertainties and position themselves for sustained growth in a competitive landscape. Each approach contributes to a more resilient and adaptable business model, ensuring that advisor practices weather industry changes and also thrive.

Increase Revenue with Client Segmentation and Targeting

Unlocking new revenue streams begins with a nuanced understanding of your client base. By delving into their needs and preferences, financial advisors can tailor their services for maximum impact.

Client segmentation is key, as it allows advisors to categorize clients based on factors such as financial goals, risk tolerance, and life stages. This segmentation enables the customization of services, ensuring that each client receives a personalized and relevant financial strategy.

Tailoring services for different client segments involves recognizing that one size does not fit all. High-net-worth clients, for instance, may require more sophisticated investment strategies and comprehensive wealth management services.

Younger clients may seek guidance on budgeting, saving, and goal-setting. By catering to the unique needs of each segment, advisors can provide specialized value that strengthens client relationships and fosters loyalty.

Strategic targeting of high-value clients further amplifies revenue potential. By focusing efforts on clients with substantial assets or those likely to expand their investments, advisors can maximize their monetization opportunities.

This targeted approach not only enhances the overall profitability of the practice but also allows advisors to deliver a higher level of service to clients who can benefit most from their expertise.

The Case for Leaving a Wirehouse

Embarking on the journey of transitioning from a wirehouse to independence is a strategic move for financial advisors seeking greater autonomy and control. Breaking away offers the freedom to tailor services, set fees, and select technology that aligns with the advisor’s vision.

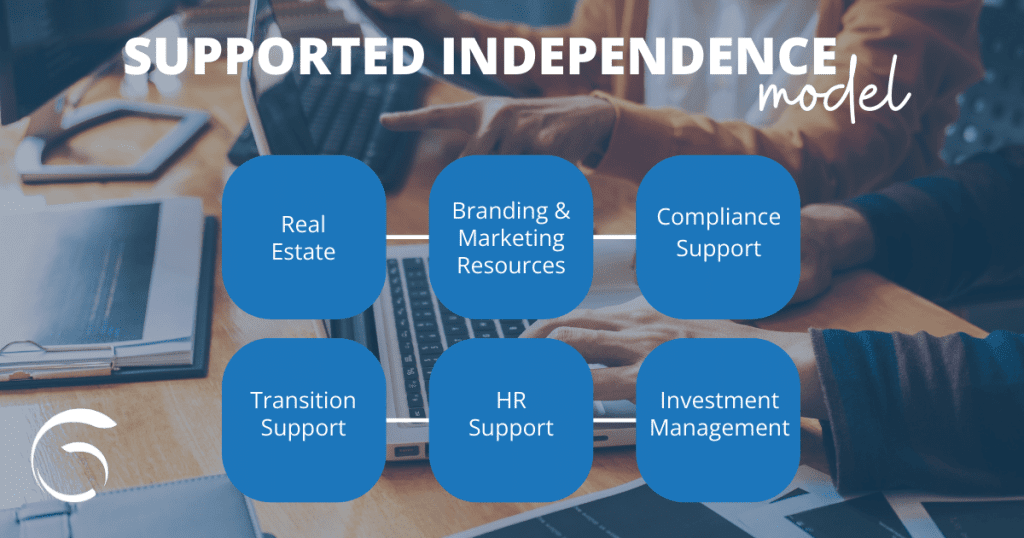

Despite the appeal, challenges like establishing a new client base and managing operational aspects can arise. Mitigating risks involves meticulous planning, leveraging existing relationships, and embracing technology for efficiency. The alternative is to consider a “Supported Independence” model, which will increase the potential for more immediate profitability.

Drive Growth with Supported Independence

Unlock the potential of Supported Independence to enhance your independent practice. Our team is ready to guide you towards a more streamlined, client-focused approach, allowing you the freedom to concentrate on your priorities while we manage the rest.

Frequently Asked Questions

Selling your financial planning practice involves assessing its value, preparing the business for sale, finding potential buyers, and negotiating terms, among other tasks. Effective client communication is essential, and once an agreement is reached, finalize the deal, transfer ownership, and address post-sale commitments. Seek professional guidance and legal assistance for a smooth and successful transition.

Financial advisors grow their business by focusing on client acquisition, expanding service offerings, and leveraging technology for efficiency gains. They can explore new markets, enhance their online presence, and engage in strategic networking. Building strong client relationships, staying informed about industry trends, and consistently delivering high-quality service are key components of sustainable growth.

The four major growth strategies for financial advisors (FAs) include client segmentation and targeting, monetization diversification through new services and fee-based models, leveraging technology for efficiency gains, and, when applicable, considering the advantages of transitioning from a wirehouse for increased autonomy and control.